According to a new report by MarketsandMarkets™ - Companion Diagnostics Market in terms of revenue was estimated to be worth $7.5 billion in 2024 and is poised to reach $13.6 billion by 2029, growing at a CAGR of 12.6% from 2024 to 2029.

The global companion diagnostics market is poised for significant growth in the near future, driven by the increasing incidence of cancers worldwide. This rise in cancer cases is fueling the demand for more accurate and personalized treatment options. Companion diagnostics play a crucial role in this scenario by helping to select appropriate targeted therapies for patients based on their genetic makeup and likely response. This personalized approach is expected to improve treatment outcomes while reducing adverse reactions to unsuited medicines. Additionally, the approvals of many targeted oncology drugs, along with complementary companion diagnostics, by regulatory agencies are expected to further propel the market growth. Emerging economies like China, Japan, and India are presenting attractive opportunities for companies operating in this market.

Download an Illustrative overview: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=155571681

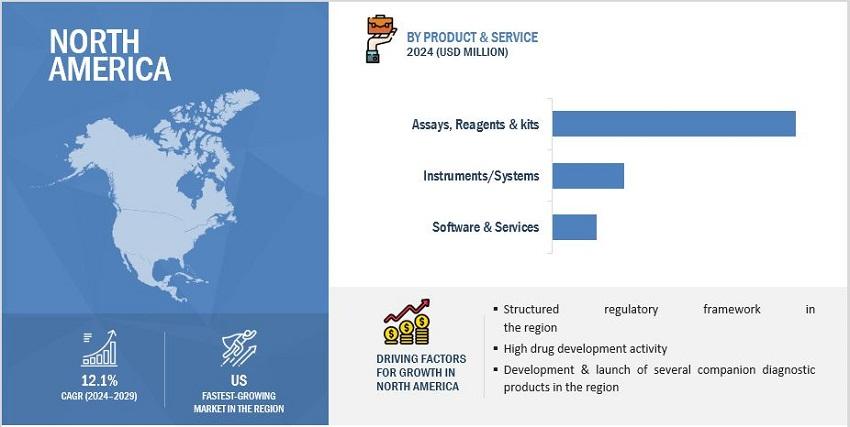

Based on product & service, the companion diagnostics market is segmented into assays, kits & reagents, instruments/systems and software & services. The dominance of the assays, kits & reagents segment in 2023 can be attributed primarily to the broad range of available products and the rapidly increasing utilization of assays and kits across various therapeutic areas.

Based on technology, the companion diagnostics market is categorized into polymerase chain reaction (PCR), in situ hybridization (ISH), next-generation sequencing (NGS), immunohistochemistry (IHC), and other technologies. In 2023, the PCR segment held the largest portion of the companion diagnostics market. PCR has become essential in companion diagnostics, especially in the interpretive practice by pharmaceutical companies related to oncology drugs, due to its reliability, sensitivity, and ability to obtain quantitative results. Its extensive range of applications and established market presence give it a significant position in the field.

Based on indication, the companion diagnostics market is segmented into cancer, cardiovascular diseases (CVDs), neurological diseases, infectious diseases, and other indications (inflammatory and inherited diseases, among others). In 2023, the cancer segment held the largest share of the companion diagnostics market. This can be attributed to factors such as the expanding role of companion diagnostics in personalized medicine treatments for cancer, as well as the growing importance of biomarkers in cancer diagnosis.

Based on sample type, the companion diagnostics market is segmented into liquid, blood, and other sample types. In 2023, the tissue sample segment accounted for the largest share of the companion diagnostics market. Tissue samples are often preferred in companion diagnostics for their ability to provide a direct analysis of the tumor, offering a comprehensive view of genetic mutations and biomarkers for more accurate and personalized treatment decisions.

Based on end user, the companion diagnostics market is segmented into pharmaceutical & biotechnology companies, reference laboratories, CROs, and other end users (including physician & hospital laboratories and academic medical centers). The pharmaceutical & biotechnology companies segment held the largest share of the companion diagnostics market in 2023. This is primarily driven by factors such as the rising utilization of companion diagnostics in drug development and the growing significance of companion diagnostic biomarkers.

The global companion diagnostics market is divided into six key regions: North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC countries. In 2023, North America held the largest portion of the companion diagnostics market. The growth of the North American companion diagnostics market can be credited to several factors, including the significant presence of leading companion diagnostics vendors and national clinical laboratories. Additionally, the easy access to technologically advanced devices and instruments, along with the highly developed healthcare systems in the US and Canada, contributed to the market's expansion in this region.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=155571681

Companion Diagnostics Market Dynamics:

Drivers:

- Increasing significance of personalized medicine

Restraints:

- High capital investment and low cost-benefit ratio

Opportunities:

- Increasing importance of companion diagnostics in drug development

Challenge:

- The shortage of adequately trained professionals

Key Market Players of Companion Diagnostics Industry:

The major players in this market are F. Hoffmann-La Roche Ltd (Switzerland), Agilent Technologies, Inc. (US), QIAGEN (Netherlands), Thermo Fisher Scientific Inc. (US), Abbott (US), Almac Group (UK), Danaher (US), Illumina, Inc. (US), bioMérieux (France), Myriad Genetics, Inc. (US), Sysmex Corporation (Japan), ARUP Laboratories (UK), Abnova Corporation (Taiwan), Guardant Health (US), ICON Plc (Ireland), BioGenex (US), Invivoscribe, Inc. (US), ArcherDX, Inc. (Integrated DNA Technologies, Inc.) (US), NG Biotech (France), Q² Solutions (US), Amoy Diagnostics Co., Ltd. (China), Uniogen (Abacus Diagnostica) (Finland), Asuragen, Inc. (Bio-Techne) (US), NG Biotech (France), Meso Scale Diagnostics, LLC. (US), and Creative Biolabs (US).

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 20%, Tier 2 - 45%, and Tier 3 -35%

- By Designation: C-level - 30%, D-level - 20%, and Others - 50%

- By Region: North America - 42%, Europe - 31%, Asia Pacific - 20%, and Rest of the World -7%

Recent Developments of Companion Diagnostics Industry:

- In August 2023, Agilent Technologies, Inc. (US) received European IVDR Certification for Companion Diagnostic Assay.

- In August 2023, QIAGEN (Netherlands). received FDA approval for companion diagnostic to Blueprint Medicines’ AYVAKIT (avapritinib) in gastrointestinal stromal tumors.

- In March 2023, F. Hoffmann-La Roche Ltd (Switzerland) received FDA approval of label expansion for VENTANA PD- L1 (SP263) Assay to identify patients with locally advanced and metastatic non-small cell lung cancer eligible for Libtayo.

- In September 2022, Thermo Fisher Scientific Inc. (US) announced FDA Approval of Oncomine Dx Target Test as the First NGS-Based Companion Diagnostic to Aid in Therapy Selection for Patients with RET Mutations/Fusions in Thyroid Cancers.

- In January 2021, F. Hoffmann-La Roche Ltd (Switzerland) launched two digital pathology image analysis algorithms for precision patient diagnosis in breast cancer.

Companion Diagnostics Market - Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall companion diagnostics market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges influencing the growth of the companion diagnostics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the companion diagnostics market.

- Market Development: Comprehensive information about lucrative markets – the report analyses the companion diagnostics market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the companion diagnostics market.

- Competitive Assessment: In-depth assessment of market ranking, growth strategies and product offerings of leading players like F. Hoffmann-La Roche Ltd (Switzerland), Agilent Technologies, Inc. (US), QIAGEN (Netherlands), Thermo Fisher Scientific Inc. (US) and Abbott (US).

Research Insights: https://www.marketsandmarkets.com/ResearchInsight/companion-diagnostics-market.asp

Content Source: https://www.marketsandmarkets.com/PressReleases/companion-diagnostics.asp